Managing Expectations of Costly Kids

by Sue Shellenbarger

Wednesday, September 15, 2010

provided byWednesday, September 15, 2010

At 10, Grace Morgan is a young fashionista and takes pains to dress in the latest styles. But her mom, Amy, works part-time and her husband was recently laid off, leaving little room in the family budget for designer-brand clothes.

| More from WSJ.com: • Kids Quit the Team For More Family Time • Handling a Boss Who Micromanages • From Children's Grief, Signs of Growth |

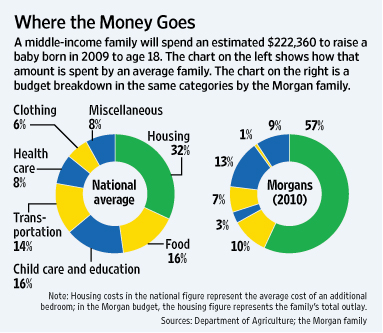

The cost of raising kids is continuing to rise. A middle-income family can expect to shell out nearly a quarter of a million dollars, or $222,360, to raise a baby born in 2009 to age 18, according to the Department of Agriculture. That is up about 1.4% from 2007, before the recession began -- and it doesn't include college costs.

[Click here to check savings products and rates in your area.]

Now, amid tight household budgets and a growing belief that today's youth will face a lasting drop in their standard of living, many parents are working to reshape children's expectations. The result is "a massive, painful shift" in behavior, as kids learn to economize or work to pay for consumer goods they want, says Jason Dorsey, an Austin, Texas, consultant to employers on intergenerational issues.

Ms. Morgan is teaching Grace and her brother Noah, 13, to resist consumer pressures. "We very openly heckle" such shows as "My Super Sweet 16" on MTV, ridiculing such excesses as when a teen receives a Mercedes or opulent vacations, she says. Both children have learned to enjoy inexpensive family camping vacations, and they sell items on eBay to raise cash for purchases. "The joke around our house is, if it's not nailed down, they will sell it," Ms. Morgan says.

Still, Grace insisted on going to Justice, a specialty chain for tweens, for back-to-school clothes. "She could have gone to Wal-Mart (NYSE: WMT - News) and gotten much more," Ms. Morgan says. But "you have to close your eyes and zip your mouth" to let kids learn to make choices.

|

But fewer families can afford to indulge their kids; 24% of parents made back-to-school shopping budgets with their kids this year, up from 18% in 2006, says a Capital One (NYSE: COF - News) survey of 500 households.

Telling a pre-teen or teen you can't afford something usually doesn't work, says Susan Beacham, founder of Money Savvy Generation, a maker of educational products for kids. "Kids are very concrete" in their thinking, she says. "If you say at the mall, 'I can't afford those shoes,' then go to a grocery store and spend $150, they don't understand the difference. They will just think, 'There she goes again.' " A better approach is to give children a budgeted amount for necessities and require them to stick to it and account for their spending, she says.

Laura Pavlides turns her two sons' pleas to buy stuff into teaching moments. En route to swim practice recently near their Glenwood, Md., home, her son John Thomas, 12, eyed a new SUV with a DVD player in back and began pressing her to replace their road-worn 2006 minivan. "Let's get a new car! We could watch movies!" Ms. Pavlides says he told her.

Rather than brushing him off, she argued that a DVD player would choke off family conversations. Then she explained that borrowing $26,000 to buy a car would actually cost $45,000 with interest, she says. "What? That's robbery!" John Thomas exclaimed.

[How to Get a College Degree Debt-Free]

He and his brother Chris, 11, still come home from friends' houses talking about the toys and nice cars they see. But they also understand debt can be a burden; they notice bills piled up on their friends' dining-room tables, or their friends' parents "fighting in the kitchen over the grocery bill," Ms. Pavlides says.

Peer pressure can undermine parents' efforts. While teens in the past "could leave school and go home" to escape, "now, peer pressure never turns off. Kids go home and a friend posts a photo of her new purse on Facebook," says Mr. Dorsey, the consultant. Teens "are no longer competing with the Jones's kids. They are competing with 500 Facebook friends across the country."

Heather Joplin was taught as a child to stick to a budget, and her parents set an example of living on less than they make, says her father Toby Joplin, of Broken Arrow, Okla. But when Heather started college, she felt "a lot of pressure to keep up and have the name brands and the pricey cars," she says. At first, Ms. Joplin, 21, who works 20 hours a week to help pay for college, tried to keep up with other students by buying trendy clothes.

"But after a while, I realized it wasn't worth it," she says. She deleted her Facebook page last year to reduce the peer pressure, she says. She has since found campus friends with similar values, and she is back on Facebook. The social pressure just "isn't as important to me any more."

Bucking the consumer culture isn't easy for parents either. Ellen Thomas of Columbia, Mo., agonizes over setting tougher limits on her two teens than their friends face. Dr. Thomas, who works part-time as a pediatrician, and her husband, an executive at a nonprofit, hold down spending on clothes, own only one car, and require their kids, 14 and 15, to ride bikes or a city bus to school and activities. She worries that the rules "are hard on" her teens, she says.

[Dancing Toddler Ad Is a Big Hit]

Her daughter Emily, 15, remembers wanting in middle school "to wear name-brand clothes. It was difficult. I just really didn't fit in," she says. She sometimes resents riding her bike to high school while friends ride in cars with their parents.

But in time, "I have found my place," she says. She has found friends with similar values, and realizes that "it's the weird things about my parents that make me unique," she says. "Having to deal with that has definitely made me a better person, and more able to" cope with challenges, she says. "In the end, my parents are right."

Write to Sue Shellenbarger at sue.shellenbarger@wsj.com

http://finance.yahoo.com/family-home/article/110673/expectations-of-costly-kids?mod=family-kids_parents

(ex).jpg)